Calculating Tax Basis For Partnership

Income business qualified deduction worksheet qbi calculation form individuals instructions update 1040 derived Capital gains income tax background information » publications Tax liability calculation corporate

Shareholder Basis Input and Calculation in the S Corporation Module

Outside basis (tax basis) – edward bodmer – project and corporate finance Update on the qualified business income deduction for individuals Shareholder basis corporation calculation tax input module repeat each

Income taxable tax corporate

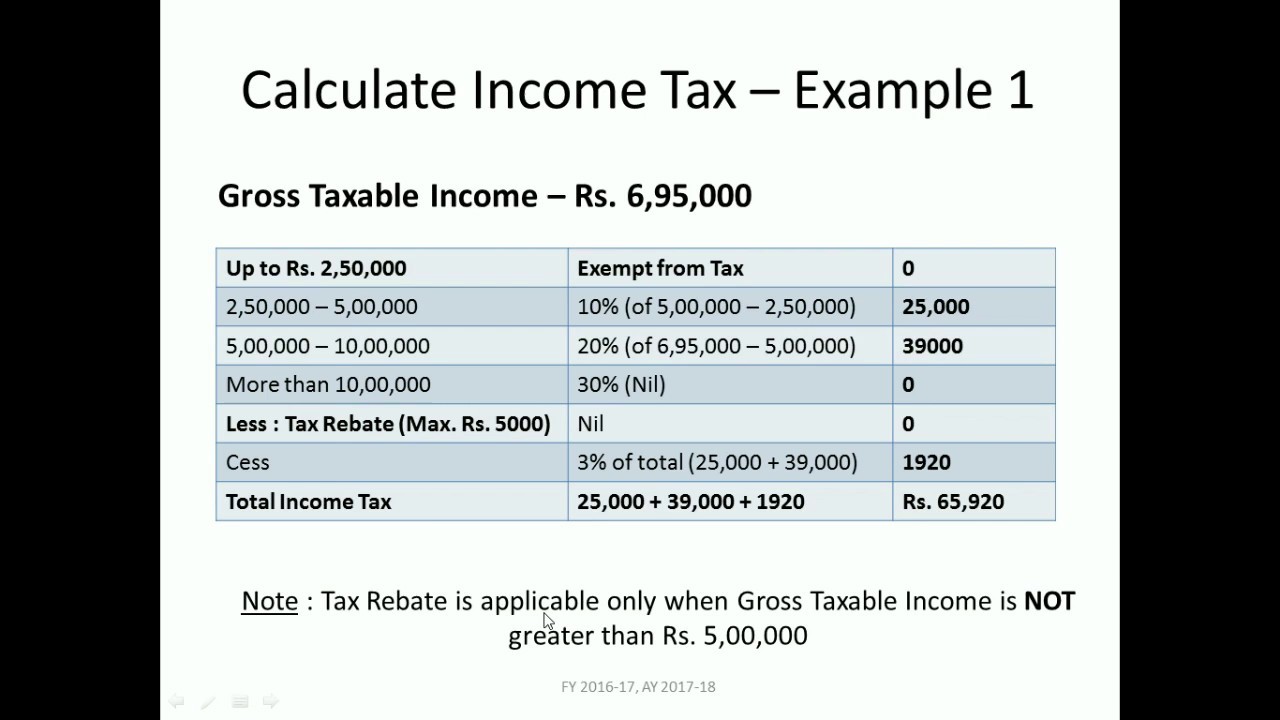

Shareholder basis input and calculation in the s corporation moduleHow to calculate income tax fy 2016-17 Tax income calculateTax calculator taxes estimate refund.

Rev basis pennsylvania templaterollerAccomplishing estate planning goals through the use of partnership Tax calculator: estimate 2015 tax refunds for 2014 taxesTax equity structures in u.s. – dro’s, stop loss, outside capital.

Corporate tax liability calculation

Llc accounting tax basis examples conversions finalTax income partnership goals accomplishing rules planning estate use llc total taxable interest through father other employment self Calculating corporate taxable income and income tax (p2-43)Outside tax capital basis account accounts structures equity loss stop partnership dro accounting.

Tax corporate definition meaning rates income taxes federal states business usa united companies government pay market individual marketbusinessnews incomes leviesBasis tax partnership calculate publicly traded Tax ipse currency nexus belize unbelievable unjust uneconomical gas gains bills finance gallonCorporate tax.

Taxprepsmart: how to calculate tax basis of publicly traded partnership

Basis taxBasis debt calculating stock distributions example distribution exhibit study do thetaxadviser issues dec Form rev-999Accounting for llc conversions.

Calculating basis in debt .